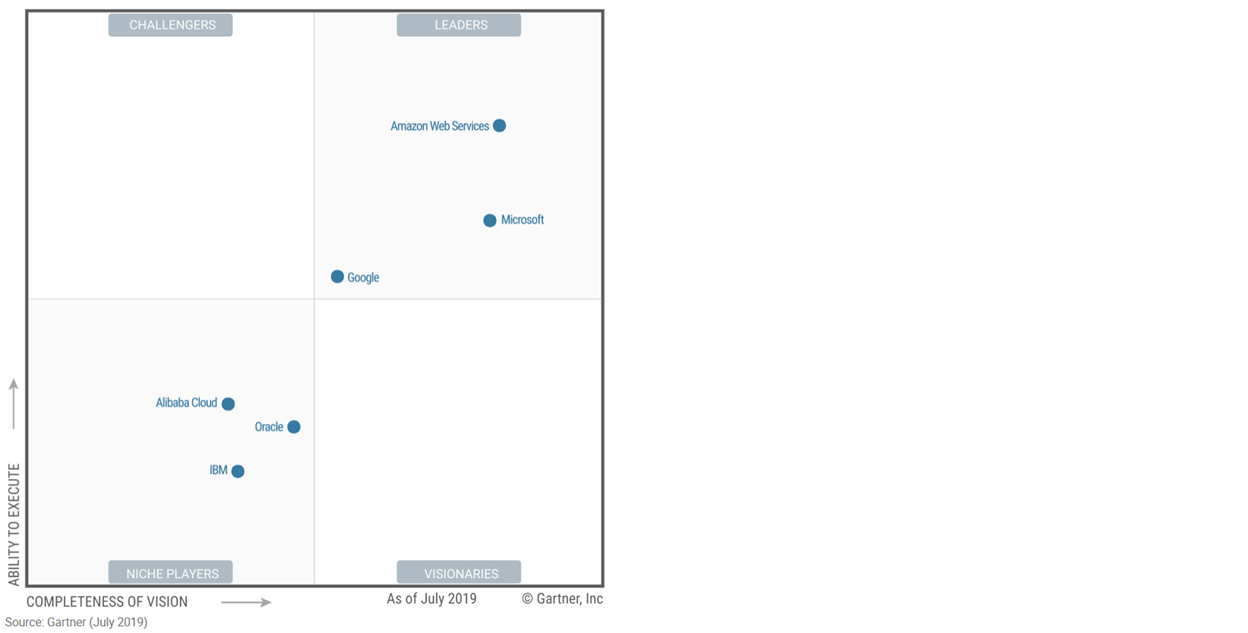

Magic Quadrant for Cloud Infrastructure as a Service, Worldwide

Market Definition/Description

Cloud computing is a style of computing in which scalable and elastic IT-enabled capabilities are delivered as a service using internet technologies. Cloud infrastructure as a service (IaaS) is a type of cloud computing service; it parallels the infrastructure and data center initiatives of IT. In the context of this Magic Quadrant, cloud IaaS is defined as a standardized, highly automated offering, where compute resources, complemented by storage and networking capabilities, are owned by a service provider and offered to the customer on demand. The resources are scalable and elastic in near real time, and metered by use. Self-service interfaces are exposed directly to the customer, including a web-based UI and an API. The resources may be single-tenant or multitenant, and hosted by the service provider or on-premises in the customer’s data center. Thus, this Magic Quadrant covers both public and private cloud IaaS offerings.

Enterprise adoption of cloud IaaS often begins with modern workloads, emphasizing developer productivity and business agility. But an increasing amount of cloud IaaS is being bought for traditional IT, with an emphasis on cost reduction, safety and security. Infrastructure and operations (I&O) leaders typically lead the sourcing when cloud IaaS is to be used for traditional IT. By contrast, sourcing for modern workloads is typically driven by enterprise architects, application development leaders and digital business leaders. This Magic Quadrant considers both sourcing patterns and their associated customer behaviors and requirements. Many enterprises require third-party managed service providers in order to effectively utilize cloud IaaS. In those cases, enterprises should use this Magic Quadrant in conjunction with the “Magic Quadrant for Public Cloud Infrastructure Managed Service Providers, Worldwide,” which covers third-party managed service providers.

Magic Quadrant

Source: https://www.gartner.com/doc/reprints?id=1-6Q8NFZA&ct=190523&st=sb

Vendor Strengths and Cautions

Alibaba Cloud

Alibaba Cloud, also known as Aliyun in Chinese, is a cloud-focused service provider with headquarters in China and is a subsidiary of Alibaba Group. Founded in 2009 to provide platform services to Alibaba Group’s e-commerce businesses, Alibaba Cloud now sells to companies around the world. This Magic Quadrant evaluation is focused upon Alibaba Cloud’s international business, which is headquartered in Singapore, and our technical assessment was performed using the international service.

Offerings: Alibaba Cloud is integrated IaaS+PaaS. It offers Xen and KVM-virtualized multitenant compute (Elastic Compute Service) with compute-independent block storage (cloud disks). It also offers object storage (Alibaba Object Storage Service), a CDN service, a Docker-based container service (Cloud Container Service), preconfigured private cloud infrastructure (Apsara Stack and ET Brain) and a variety of PaaS-layer services including a family of database services (ApsaraDB).

Locations: Alibaba Cloud operates multiple regions in China and additionally has a presence in the U.S. (East and West Coasts), Germany, Australia, Hong Kong, Indonesia, Japan, India, Malaysia, Singapore, United Arab Emirates and the United Kingdom. It has local sales in the U.S., China, Germany, Australia, Japan, Hong Kong and Singapore. The China service portal, documentation and support are in Mandarin. The international portal, documentation and support are in English, Mandarin and Japanese.

Adoption profile: Alibaba Cloud is the current market share leader for cloud IaaS in China (42%) and performs particularly well with Chinese digital businesses and Chinese public-sector entities. In China, Alibaba offers private cloud infrastructure options for Chinese companies that want a hybrid cloud model. Outside of China, despite announced partnerships in 2018 with SAP and VMware, Alibaba Cloud is most typically used by Mode 2 buyers in the Asia/Pacific region seeking a platform for agile workloads.

Recommended uses: Cloud-first digital business workloads for customers that are (1) based in China or Southeast Asia and wish to leverage Alibaba Cloud’s relationship with its parent company, or (2) need to locate cloud infrastructure in China.

Strengths

- Alibaba Cloud has an extensive set of public cloud integrated IaaS+PaaS offerings, comparable in scope to the service portfolios of other globally focused hyperscale providers.

- Alibaba Cloud is the market share leader for cloud IaaS in China, where it has positive customer satisfaction ratings along with strong ties to the Chinese public sector. Chinese businesses view Alibaba Cloud as an enabler of digital transformation and a conduit to begin earning digital revenue.

- Alibaba Cloud has close affiliation with the Alibaba Group of companies, enabling Alibaba Cloud to act as bridge into China for international companies, and a bridge out of China for Chinese companies.

Cautions

- Alibaba Cloud’s international offering does not have the full capabilities of the China offering, nor the feature depth of its major global competitors (Amazon Web Services, Microsoft, Google). In many regions, specific services may only be available when using certain compute instance types.

- Alibaba Cloud earns 90% of its revenue in China and has not appreciably grown its enterprise customer base outside of China. Alibaba has limited capabilities in terms of an MSP ecosystem, third-party enterprise software integration and operational tools; and small global field teams limit adoption outside of China.

- Alibaba Cloud’s financial losses are increasing and may prevent the company from continuing to invest in necessary expansions to serve international markets as the leading hyperscale provider.

Amazon Web Services

Amazon Web Services (AWS), a subsidiary of Amazon, is a cloud-focused service provider. It pioneered the cloud IaaS market in 2006.

Offerings: AWS is integrated IaaS+PaaS. Its Elastic Compute Cloud (EC2) offers metered-by-the-second multitenant and single-tenant VMs, as well as bare-metal servers. AWS’s hypervisors are based on Xen and KVM. There is multitenant block and file storage, along with extensive additional IaaS and PaaS capabilities. These include object storage with an integrated CDN (Amazon Simple Storage Service [S3] and CloudFront), Docker container services (Amazon EC2 Container Service [ECS], ECS for Kubernetes [EKS], and Fargate) and event-driven “serverless computing” (AWS Lambda). VMware offers a VMware Cloud Foundation service within AWS data centers (VMware Cloud on AWS). Enterprise-grade support is extra. It has a multi-fault-domain SLA. Colocation needs are met via partner exchanges (AWS Direct Connect).

Locations: AWS groups its data centers into Regions, each of which contains at least two availability zones (data centers). It has multiple Regions across the U.S., as well as in Canada, France, Germany, Ireland, the U.K., Australia, India, Japan, Singapore, South Korea, Sweden and Brazil. It also has one Region dedicated to the U.S. federal government. There are two China Regions — Beijing (operated by Sinnet) and Ningxia (operated by Ningxia Western Cloud Data Technology [NWCD]) — which require a China-specific AWS account. It has a global sales presence. The portal and documentation are provided in English, Dutch, French, German, Italian, Japanese, Korean, Mandarin, Portuguese and Spanish. The primary languages for support are English, Japanese and Mandarin, but AWS will contractually commit to providing support in a large number of other languages.

Adoption profile: AWS strongly appeals to buyers seeking agile operations, but is also frequently chosen for traditional styles of IT operations. AWS is the provider most commonly chosen for strategic, organizationwide adoption. Transformation efforts are best undertaken in conjunction with an SI.

Recommended uses: All use cases that run well in a virtualized environment. Applications that are potentially challenging to virtualize or run in a multitenant environment — including highly secure applications, strictly compliant or complex enterprise applications (such as SAP business applications) — require special attention to architecture.

Strengths

- Enterprises make larger annual financial commitments and deploy more mission-critical workloads on AWS than with any other hyperscale provider. This speaks to how enterprises perceive AWS as a strategic provider of cloud infrastructure and platform services relative to other providers in the market.

- AWS has a broader range of customer profiles, ranging from startups and small and midsize businesses (SMBs) to large enterprises, than any other provider in this market. Enterprises using AWS benefit from the early adopters, which help to push new technologies into the mainstream, derisking such services and making them easier to consume and manage as a result.

- AWS is the most mature, enterprise-ready provider, with the strongest track record of customer success and the most useful partner ecosystem. Thus, it is the provider chosen by not only customers that value innovation and that are implementing digital business projects, but also preferred by customers that are migrating traditional data centers to cloud IaaS.

Cautions

- AWS makes frequent proclamations about the number of price reductions it has made. Customers interpret these proclamations as being applicable to the company’s services broadly, but this is not the case. For instance, the default and most frequently provisioned storage for AWS’s compute service has not experienced a price reduction since 2014, despite falling prices in the market for the raw components.

- AWS prioritizes being first to market with respect to delivering new services and capabilities. As a result, it is willing to launch feature-poor services or services without deep cross-platform integration, which it often defers to the future to address. The quest to be first to market sometimes results in services that need years of substantial engineering updates.

- As the ambitions of Amazon’s CEO expand into additional markets, the boards of directors for companies in potentially threatened verticals have directed their IT organizations to avoid the use of AWS where possible. This may ultimately limit AWS’s success in some verticals, and may impact the associated ecosystem. IT leaders in these verticals should consider a contingency plan for board-level directives.

Google is an internet-centric provider of technology and services. Google has had an aPaaS offering since 2008, but did not enter the cloud IaaS market until Google Compute Engine was launched in June 2012 (with general availability in December 2013).

Offerings: Google Cloud Platform (GCP) combines an IaaS offering (Compute Engine), an aPaaS offering (App Engine) and a range of complementary IaaS and PaaS capabilities, including object storage, a Docker container service (Google Kubernetes Engine [GKE]) and event-driven “serverless computing” (Google Cloud Functions). Google also offers GKE On-Prem (software for on-premises deployment), a container-based offering for enterprise deployments. It has a multi-fault-domain SLA. Colocation needs are met via partner exchanges (Google Cloud Interconnect).

Locations: Google has multiple regions across the U.S., as well as a presence in Belgium, Japan, Singapore, Germany, the Netherlands, the U.K., India, Australia, Brazil, Canada, Hong Kong, Switzerland and Taiwan. Google has a global sales presence. Support is available in English and Japanese. The portal is available in English, Dutch, French, German, Italian, Polish, Spanish, Turkish, Russian, Portuguese, Korean, Japanese, Mandarin, Cantonese and Thai. Documentation is available in English, German, Japanese and Brazilian Portuguese. Google operates regions with availability zones, but these zones can be separate buildings or separate power, cooling, networking, and control planes.

Adoption profile: GCP initially appealed to Mode 2 buyers with demonstrated strengths associated with big data and other analytics applications, machine learning projects, cloud-native applications, or other applications optimized for cloud-native operations. GCP is also beginning to attract enterprises with traditional Mode 1 workloads such as SAP.

Recommended uses: Big data and other analytics applications, machine learning projects, cloud-native applications, or other applications optimized for cloud-native operations.

Strengths

- Google has leveraged its internal innovative technology capabilities (e.g., automation, containers, networking) by providing a scalable IaaS offering with PaaS capabilities, centered on open-source ecosystems. While catering initially to cloud-native startups, Google is in the process of expanding its reach to enterprise customers.

- Google has differentiated technologies on the forward edge of IT, specifically in analytics and machine learning. This has driven some enterprises to select Google as a strategic cloud provider where they have deployed applications that are anchored by BigQuery.

- Google has innovated programs to assist customers with the process of operations transformation via its Customer Reliability Engineering program. The program uses a shared-operations approach to teach customers to run operations the way that Google’s site reliability engineers do. This has the potential to tether Google more closely to enterprise customers.

Cautions

- Google demonstrates an immaturity of process and procedures when dealing with enterprise accounts, which can make the company difficult to transact with at times. This can be attributed to its nascent focus on the enterprise market. The immaturity of process is most pronounced in areas such as contract negotiation, discounting, independent software vendor (ISV) licensing, integration with enterprise systems and support. Google is aggressively targeting these shortcomings.

- Google has a much smaller pool of experienced MSP and infrastructure-centric professional services partners than other vendors in this Magic Quadrant. Its own professional services are still gaining traction in driving customer implementations. Some prospective customers find that these ecosystem limitations heighten migration risk.

- Google’s overall enterprise coverage from a field sales and solutions perspective is behind its competitors. Further, enterprises often lament about Google’s inability to craft appropriate solutions for enterprise requirements when engaging with solution architects.

IBM

IBM is a large, diversified technology company with a range of cloud-related products and services. The IBM Cloud offering has been built on IBM’s July 2013 acquisition of SoftLayer and its previous Bluemix offering.

Offerings: IBM offers both multitenant and single-tenant virtualized compute resources along with bare-metal servers. It has S3-compatible Cloud Object Storage. CDN integration is offered via an Akamai partnership. IBM Cloud offers an Open Container Initiative (OCI)-based container service (IBM Cloud Kubernetes Service), event-driven serverless computing (IBM Cloud Functions), a Cloud Foundry-based aPaaS, and other PaaS capabilities. IBM also offers a Kubernetes- and container-based private cloud offering (IBM Cloud Private). Managed services are optional. Colocation needs are met via partner exchanges (IBM Cloud Direct Link).

Locations: IBM has SoftLayer infrastructure in multiple data centers in the U.S., along with data centers in Canada, Mexico, Brazil, France, Germany, Italy, the U.K., the Netherlands, Norway, Australia, Hong Kong, India, Japan, Korea, Sweden and Singapore. IBM offers formerly Bluemix-branded services in the U.S., the U.K., Germany, Australia and Japan. IBM has a global sales presence. It offers support in the wide range of languages in which IBM does business. The portal and documentation are available in English, French, German, Italian, Portuguese, Spanish, Simplified Chinese, Traditional Chinese, Korean and Japanese.

Adoption profile: IBM appeals to its existing customers who have a strong preference to purchase most of their technology from IBM. These customers primarily have Mode 1 use cases. However, IBM Cloud infrastructure capabilities may also be used to complement other IBM solutions, such as Watson.

Recommended uses: IBM outsourcing deals that use bare-metal servers as the hosting platform, where the customer has a need for supplemental basic cloud IaaS. The infrastructure may also be used as a component of applications built using the IBM Cloud PaaS capabilities. It should also be considered in circumstances that require both API control over scalable infrastructure and bare-metal servers in order to meet requirements for performance, regulatory compliance or software licensing.

Disclaimer: IBM did not respond to requests for supplemental information or for a review of the draft contents of this research. Therefore, Gartner analysis is based on other credible sources, including public information.

Strengths

- IBM has a very large base of customers with critical applications that are beginning to adopt cloud services. IBM is well positioned to partner its service businesses to assist these customers through the cloud transformation journey.

- IBM has a strong brand and existing customer relationships across the globe, and can offer support in local languages, local contracts and billing in local currency. IBM’s base of strategic outsourcing customers may help to drive adoption of IBM Cloud infrastructure.

- IBM has transitioned to messaging around hybrid and multicloud computing, which does not directly challenge many of the providers in this Magic Quadrant. Rather, it offers capabilities and tooling to enterprises, allowing them to choose the cloud environment that is best for their specific application requirements, positioning IBM Cloud as a niche or specialty offering during the selection process.

Cautions

- IBM’s Next-Generation Infrastructure (NGI) project has produced incremental improvements to the infrastructure services formerly under the SoftLayer umbrella. However, it has not delivered on its fundamental goal — to produce a new set of cloud IaaS offerings based on the principles of hyperscale architecture. Given this, it is unlikely that IBM will become a competitive public cloud IaaS provider.

- Despite having many worldwide data centers, the IBM Cloud experience remains disjointed, as many features are available only in specific locations. This and an unexceptional user experience cause IBM to have a higher level of user dissatisfaction than other vendors in this research.

- IBM has a smaller ecosystem of partners that provide adjacent tooling (e.g., cost management, security, governance). Additionally, it has fewer partnerships (in comparison to other providers) with major software vendors (Microsoft, SAP, Oracle) that could culminate in deployments on the IBM Cloud.

Microsoft

Microsoft is a large and diversified technology vendor that is increasingly focused on delivering its software capabilities via cloud services. Microsoft entered the cloud IaaS market with the launch of Azure Virtual Machines in June 2012 (with general availability in April 2013).

Offerings: Microsoft Azure is integrated IaaS+PaaS. It offers metered-by-the-second Hyper-V-virtualized multitenant compute (Azure Virtual Machines), as well as specialized large instances (such as for SAP HANA). There is multitenant block and file storage, along with many additional IaaS and PaaS capabilities. These include object storage (Azure Blob Storage), a CDN, a Docker-based container service (Azure Container Service), a batch computing service (Azure Batch) and event-driven “serverless computing” (Azure Functions). The Azure Marketplace offers third-party software and services. Colocation needs are met via partner exchanges (Azure ExpressRoute) such as those from Equinix and CoreSite.

Locations: Microsoft calls Azure data center locations “regions.” There are multiple Azure regions in the U.S., Canada, the U.K., Germany, France, Australia, India, Norway, UAE, Switzerland, Japan and Korea, as well as regions in Ireland, the Netherlands, Hong Kong, Singapore and Brazil. There are also six regions for the U.S. federal government; two are dedicated to the Department of Defense. (The two Azure China regions are part of a separate service operated by 21Vianet Group.) Microsoft has global sales. Documentation is available in English, French, German, Italian, Spanish, Portuguese (Brazil and Portugal), Japanese, Korean and Mandarin. Support and the service portal are available in those languages, plus Czech, Dutch, Hungarian, Polish, Russian, Swedish and Turkish.

Adoption profile: Microsoft Azure appeals to both Mode 1 and Mode 2 customers, but for different reasons. Mode 1 customers tend to value the ability to use Azure to extend their infrastructure-oriented Microsoft relationship and investment in Microsoft technologies. Mode 2 customers tend to value Azure’s ability to integrate with Microsoft’s application development tools and technologies, or are interested in integrated specialized PaaS capabilities, such as the Azure Data Lake, Azure Machine Learning or the Azure IoT solution accelerators.

Recommended uses: All use cases that run well in a virtualized environment, particularly for Microsoft-centric organizations.

Strengths

- Enterprises that are strategically committed to Microsoft technology generally choose Azure as their primary IaaS+PaaS provider. The integrated end-to-end experience for enterprises building .NET applications using Visual Studio and related services while deploying them to Azure is unsurpassed. Microsoft is leveraging its tremendous sales reach and ability to co-sell Azure with other Microsoft products and services in order to drive adoption.

- Azure provides a well-integrated approach to edge computing and Internet of Things (IoT), with offerings that reach from its hyperscale data center out through edge solutions such as Azure Stack and Data Box Edge.

- Microsoft Azure’s capabilities have become increasingly innovative and open, where 50% of the workloads are Linux-based along with numerous open-source application stacks. Microsoft has a unique vision for the future that involves bringing in technology partners through native, first-party offerings such as those from VMware, NetApp, Red Hat, Cray and Databricks.

Cautions

- Microsoft Azure’s reliability issues continue to be a challenge for customers, largely as a result of Azure’s growing pains. Since September 2018, Azure has had multiple service-impacting incidents, including significant outages involving Azure Active Directory. The nature of many of these outages is such that customers had no controls in order to mitigate the downtime.

- Gartner clients often experience challenges with on-time implementations within budget and that results from Microsoft setting unreasonably high expectations for customers. Much of this stems from modestly improving capabilities of Microsoft’s field sales teams to appropriately position and sell Azure within its customer base.

- Enterprises frequently lament the quality of Microsoft technical support (along with the increasing cost of support) and field solution architects. This negatively impacts customer satisfaction, and slows Azure adoption and therefore customer spending.

Oracle

Oracle is a large, diversified technology company with a range of cloud-related products and services. In November 2016, it launched Oracle Cloud Infrastructure (OCI, formerly Oracle Bare Metal Cloud Services). Oracle continues to operate a legacy service, Oracle Cloud Infrastructure Classic, but it is being rapidly deprecated in favor of OCI.

Offerings: OCI offers both paid-by-the-hour, KVM-virtualized VMs as well as bare-metal servers (including a one-click installation and configuration of Oracle Database, Real Application Clusters [RAC] and Exadata) and a Docker- and Kubernetes-based container service (Oracle Container Engine for Kubernetes). Oracle also offers object storage (OCI Object Storage, formerly Oracle Bare Metal Cloud Object Storage). Oracle previously offered Oracle Cloud at Customer, a private cloud IaaS offering, but it is no longer being sold. Colocation needs are met via partner exchanges (Oracle FastConnect).

Locations: The OCI data centers are grouped into regions, some having only one availability zone, such as those in Canada and Japan. Regions with three availability zones are located in the east and west of the U.S., and in Germany and the U.K. Oracle has global sales. OCI’s portal documentation is available only in English, but the portal is available in 28 additional languages.

Recommended mode: OCI will appeal to customers with mainly Oracle workloads with Mode 1 styles of operation, especially those with performance needs that are well suited to bare-metal servers, and those that do not need more than very basic cloud IaaS capabilities.

Recommended uses: OCI is best suited for enterprises requiring cloud IaaS for Oracle applications and for applications that require an Oracle Database.

Strengths

- Oracle’s cloud strategy is anchored by its applications, database and other middleware, and spans IaaS, PaaS, and SaaS. Oracle’s cloud IaaS is primarily an infrastructure foundation for its other businesses. Oracle is mainly targeting customers who want to run Oracle software on cloud IaaS, particularly those who prefer to run on Exadata appliances and bare-metal servers.

- Few companies of Oracle’s lineage have been able to design a true hyperscale architecture. OCI stands out for being able to attract top talent from the leading cloud service providers in order to pursue the goal of building well-designed cloud infrastructure.

- Oracle has made good year-over-year progress in terms of new customer growth and of existing customers increasing their usage of OCI. Reference customers also comment as to the positive performance experienced with the platform.

Cautions

- Oracle is unlikely to ever be viewed by the market as a general-purpose provider of integrated IaaS and PaaS offerings. This is due to the dominance of the hyperscale providers, Oracle’s late start with OCI, and the polarizing nature of Oracle in the minds of developers who often are the leading influencers for public cloud IaaS.

- Many features developed for OCI will not be extensively used by Oracle’s core customer base as the company is building capabilities mainly in response to RFPs, which are often designed around the capabilities of the established hyperscale providers.

- In the past year, Oracle reprioritized its development roadmap in response to customer feedback. Basic management features were implemented, at the expense of a significant delay in introducing other services considered minimally viable in the current cloud IaaS market. This sort of departure from planned roadmap items should be expected, given the nascent nature of OCI’s capabilities and the need to dynamically prioritize the roadmap based on deals won.

Dascase provides critical DevOps-as-a-Service, Infrastructure as a Code, Cloud Migrations, Infrastructure solutions and Digital transformation to high growth companies looking for expert support with DevOps, Kubernetes, cloud security, cloud infrastructure, and CI/CD pipelines. Our managed and consulting services are a more cost-effective option than hiring in-house, and we scale as your team and company grow. Check out some of the use cases, learn how we work with clients, and read more about our Service offering.

No responses yet